How Much Is Fica Tax 2025

How Much Is Fica Tax 2025 - How To Calculate Fica Tax 2025 Megan Madalena, The social security tax rates for both employees and employers will remain unchanged at 6.2%, with the maximum tax for each rising from $10,453.20 in 2025 to. Understanding FICA Tax What You Need to Know Cowdery Tax, For 2025, the ssa has set the cola at 2.5%.

How To Calculate Fica Tax 2025 Megan Madalena, The social security tax rates for both employees and employers will remain unchanged at 6.2%, with the maximum tax for each rising from $10,453.20 in 2025 to.

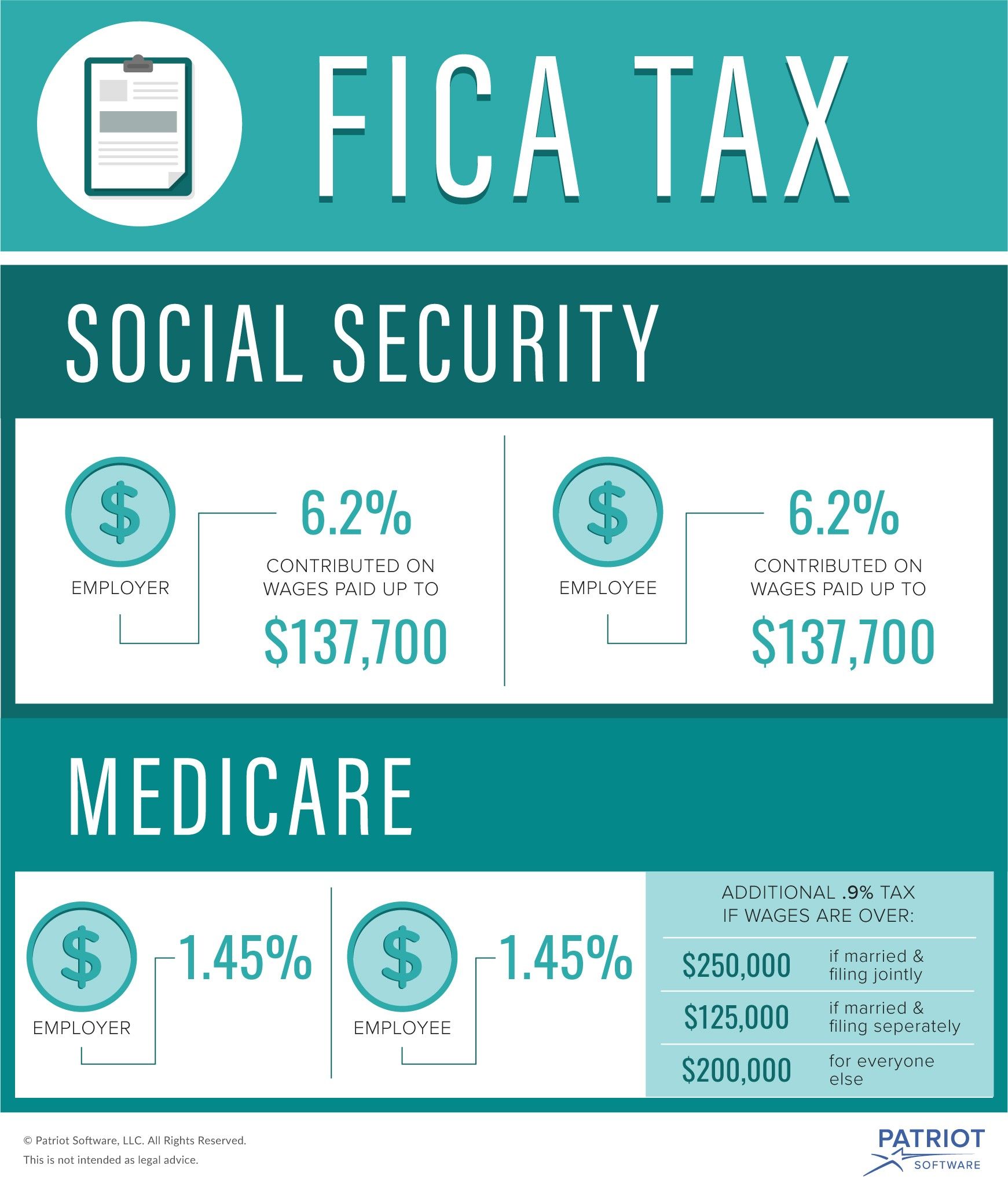

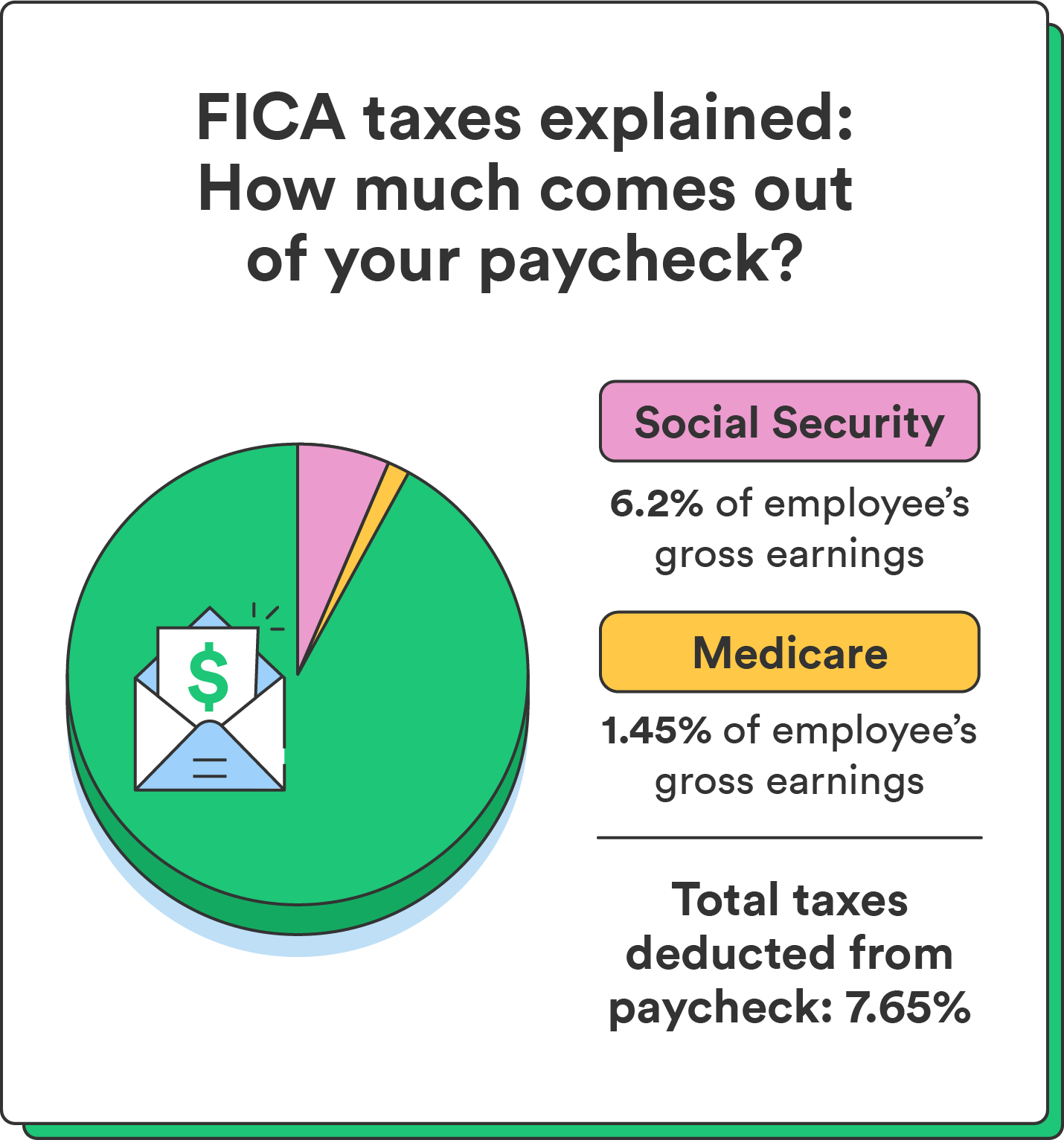

Fica Tax Amount 2025 Penelope Parsons, They generally add up to 7.65% of your wages or salary and are mandatory.

/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

What Is Fica Limit For 2025 Dacia Dorotea, For 2025, the ssa has set the cola at 2.5%.

How Much Is Fica Tax 2025. The social security tax rate is unchanged for. 10 announced a higher threshold for earnings.

2025 Fica Tax Rates And Limits Andre Amills, That’d be a $6,300 increase from the.

What Is FICA tax, and How Much Is It? Contributions, Due Dates, & More, Employees and employers split the total cost.

How To Calculate Fica Tax 2025 Megan Madalena, That’d be a $6,300 increase from the.

What Is FICA Tax How It Works And Why You Pay Poprouser, According to the intermediate projection issued in a may 2025 report, the social security taxable wage next year will be $174,900.

2025 Fica Tax Rates And Limits Andre Amills, Fica stands for the federal insurance contributions act and requires employers to withhold three separate taxes from an employee’s gross earnings:

Employer Fica And Medicare Rates 2025 Opm Sarah Short, Fica is a 15.3% payroll tax that funds social security and medicare.

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Tax rates are set by law (see sections 1401, 3101, and 3111 of the internal revenue code) and apply to earnings up to a maximum amount for oasdi. The social security tax rates for both employees and employers will remain unchanged at 6.2%, with the maximum tax for each rising from $10,453.20 in 2025 to.